Nvidia’s Growth Prospects Soar: Bank of America Projects 37% Upside

Nvidia’s stock recently hit an all-time high, and analysts at Bank of America see even more potential for growth. This excitement comes on the heels of a significant upward adjustment to their price target for this AI powerhouse, forecasting a bright future as the demand for artificial intelligence technology surges.

A Bold New Price Target

The Bank of America team, guided by analyst Vivek Arya, has raised Nvidia’s target price from $165 to $190. This new target suggests a remarkable 37% upside from Nvidia’s recent closing price of $138, marking a new high for the week.

A Generational Opportunity

The analysts assert that a “generational opportunity” lies ahead for Nvidia in the realm of AI accelerators—comprehensive semiconductor systems crucial for generative AI applications. Currently, Nvidia commands an impressive 80% market share in this space, fueled by lucrative partnerships with major tech players like Alphabet, Meta, and OpenAI, who are all investing heavily in Nvidia’s cutting-edge GPUs to train their large-language models.

Market Trends and Projections

Bank of America anticipates that the total addressable market for AI technology will see explosive growth, soaring from $45 billion in 2023 to an estimated $363 billion by the end of the decade. With Nvidia maintaining a significant 75% stake in this market, the company’s AI computing revenues could reach a staggering $272 billion by 2030. For perspective, Apple generated $204 billion in revenue from iPhones in 2023 alone.

Favorable Financial Landscape

Nvidia’s profitability isn’t just driven by its GPUs; Bank of America highlights its considerably higher profit margins compared to competitors. With a projected free cash flow margin of about 50% over the next two years, Nvidia is set to outperform other technology giants. Furthermore, Nvidia’s partnerships with consulting firms like Accenture and tech leader Microsoft are considered “underappreciated” income streams that bolster its financial strength.

A Potential Market Cap Milestone

With the updated price target of $190, Nvidia’s market capitalization could skyrocket to an impressive $4.7 trillion. This valuation would surpass any public company by a substantial margin, exceeding Apple’s current record of $3.6 trillion.

Historical Context

Today, Nvidia stands as the second-most valuable company globally, boasting a market cap of $3.4 trillion. This is a remarkable evolution from just a decade ago when the company was valued at roughly $10 billion. The recent spike in growth can be largely attributed to the launch of OpenAI’s ChatGPT, which ignited demand for Nvidia’s GPUs, integral to AI applications. The results speak for themselves: Nvidia’s sales and net income skyrocketed—350% and 2,400% higher, respectively, for the quarter ending in July compared to the same period last year.

Looking Ahead

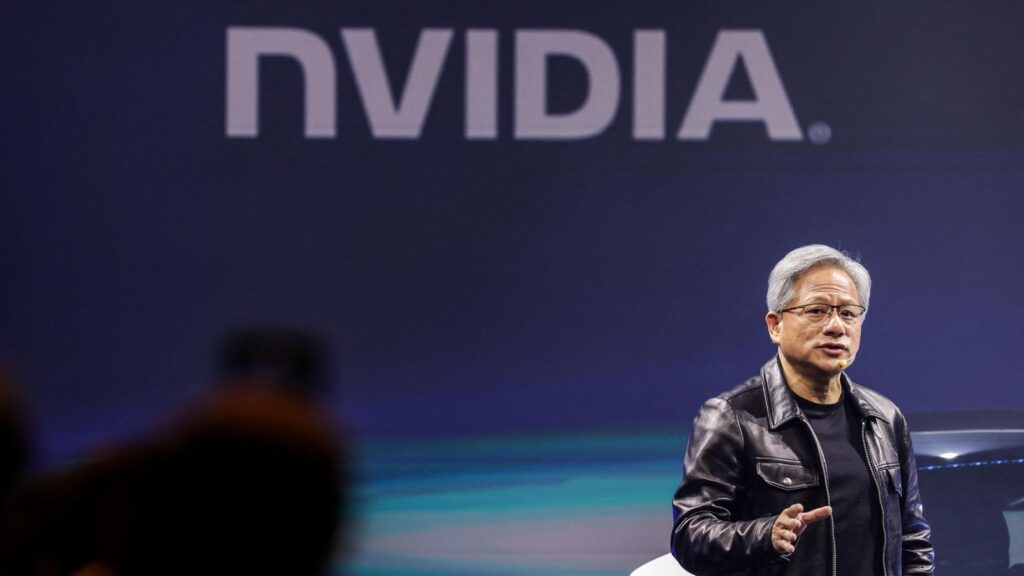

As Nvidia continues to innovate and lead the AI field, the prospects seem limitless. With CEO Jensen Huang still at the helm, guiding the company through its transformation from a gaming-focused brand to a titan in AI technology, many analysts remain bullish despite the high valuation metrics like its price-to-sales ratio.

The story of Nvidia exemplifies the ever-changing landscape of technology and the thrilling opportunities that lie ahead for investors and tech enthusiasts alike.

The AI Buzz Hub team is excited to see where these breakthroughs take us. Want to stay in the loop on all things AI? Subscribe to our newsletter or share this article with your fellow enthusiasts.