The Next Era of Cybersecurity: CrowdStrike vs. SentinelOne

In today’s digital landscape, the stakes for cybersecurity have never been higher. Advanced cyber threats are evolving, becoming increasingly sophisticated and harder to detect. Traditional antivirus programs seem to have lost their efficacy in safeguarding our devices, leading to a surge in innovative companies like CrowdStrike Holdings (NASDAQ: CRWD) and SentinelOne (NYSE: S), both of which are redefining cybersecurity through cutting-edge technology.

These companies protect some of the world’s largest corporations and are rapidly gaining market share, disrupting older competitors stuck in conventional technology. How have they achieved this? By leveraging artificial intelligence (AI) to dynamically respond to emerging threats in real time.

Understanding the New Face of Cybersecurity

Both CrowdStrike and SentinelOne focus on endpoint protection, which encompasses securing every physical or virtual device connected to a network—be it a laptop, tablet, or smartphone. However, they have expanded their scope beyond just endpoint security, venturing into critical areas like cloud and identity security as well.

Traditional antivirus solutions work by logging known threats and monitoring for those specific signatures. Unfortunately, this leaves them blind to new and emerging threats that don’t match their existing database. CrowdStrike and SentinelOne take a different approach; instead of just reacting to known threats, they continuously monitor device activity and use AI to analyze patterns and behaviors. This proactive methodology enables them to detect suspicious activity and respond to even unseen threats much faster.

Both companies have received high scores in third-party evaluations, with CrowdStrike earning a "leader" status in endpoint security from Gartner for five consecutive years, while SentinelOne boasts its own impressive four-year track record. Their ratings on Gartner’s Peer Insights platform are similarly high, with average scores of 4.8 and 4.7 out of 5, respectively—based on thousands of reviews.

A Closer Look at Stock Performance

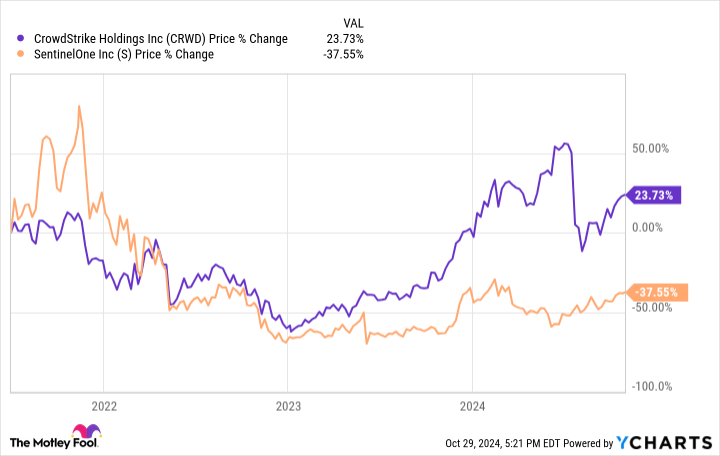

While both companies boast innovative technologies, their stock performances have diverged significantly.

CrowdStrike shines with a substantial lead in market valuation, generating approximately $3.5 billion in revenue over the past year—outpacing SentinelOne’s $723 million revenue. This contrast has positioned CrowdStrike as a giant in the sector, while SentinelOne takes on the role of the beloved underdog.

Moreover, CrowdStrike’s profitability metrics further amplify its advantage. With nearly 30% of its revenue converting to free cash flow, it has maintained GAAP profitability, whereas SentinelOne only recently reached a positive cash flow while still navigating losses on a GAAP basis.

SentinelOne’s initial public offering in mid-2021 came at an inopportune time, when tech stocks were overvalued. At its peak, SentinelOne’s enterprise value-to-sales ratio soared past an unsustainable 120, but that figure has since declined, bringing its valuation down to roughly half that of CrowdStrike.

The Road Ahead for SentinelOne

Despite these hurdles, SentinelOne is showing signs of recovery. As it edges closer to sustainable profitability, the company is well-funded, possessing $708 million in cash and no debt. This financial flexibility gives it room to invest in crucial areas like marketing, product development, and strategic acquisitions.

Recent partnerships, such as the agreement with Lenovo to include its security software on Lenovo PCs, may provide the momentum SentinelOne needs to sustain its growth trajectory. While CrowdStrike has also seen impressive revenue growth, a recent IT outage raised questions about reliability, potentially opening the door for SentinelOne to capture some of CrowdStrike’s business as contracts come up for renewal.

Conclusion: The Underdog’s Potential

Given these insights, while CrowdStrike has had a significant head start and shows impressive performance, the potential for growth at SentinelOne cannot be overlooked. As it matures and its finances stabilize, there’s a strong chance the stock could catch up and outperform in the long run.

Ultimately, both CrowdStrike and SentinelOne present unique investment opportunities in the landscape of AI-driven cybersecurity. If you’re aligned with the narrative of empowering underdogs, investing in SentinelOne may be the move for you.

The AI Buzz Hub team is excited to see where these breakthroughs take us. Want to stay in the loop on all things AI? Subscribe to our newsletter or share this article with your fellow enthusiasts.