SoftBank’s Ambitious Investment in OpenAI: A New Era in AI Development

SoftBank, the Japanese technology conglomerate known for its bold investment strategies, is reportedly in negotiations to inject up to $25 billion into OpenAI. According to a recent Financial Times report, this partnership could evolve into a whopping $40 billion commitment towards artificial intelligence initiatives with the Microsoft-backed AI powerhouse.

A Splendid Partnership

If finalized, this investment would solidify SoftBank as OpenAI’s largest investor, overtaking Microsoft, which initially backed OpenAI back in 2019. The timing of this potential deal is noteworthy, as it follows the announcement of a joint investment in Stargate—a monumental data center project located in the U.S. for OpenAI. This project aims for a staggering investment of $100 billion, with the possibility of extending to $500 billion over the next four years.

Financial Details of the Deal

SoftBank is looking at an investment of between $15 billion and $25 billion directly into OpenAI. This would come in addition to its previously mentioned $15 billion commitment to the Stargate project. Notably, OpenAI is also set to contribute approximately $15 billion towards Stargate, which suggests that SoftBank’s equity investment might play a crucial role in financing OpenAI’s infrastructure commitments.

Navigating a Competitive Landscape

These discussions emerge amidst increasing competition in the AI sector. Recently, DeepSeek, a Chinese company, introduced its R1 “reasoning” model developed on a relatively modest budget, which sent shockwaves through the markets. The implications for major players like Nvidia were evident— the chipmaker saw a staggering loss of nearly $589 billion in a day, highlighting the mounting anxiety among investors about the sustainability of hefty investments in AI hardware.

OpenAI alleges that DeepSeek may have used its proprietary models to train the R1 model via a technique termed "distillation." This method allows developers to achieve similar performance metrics while utilizing smaller and more cost-effective models. OpenAI insists this violates their terms of service, which explicitly prohibits using outputs to develop competing technologies.

SoftBank’s Strategic Move

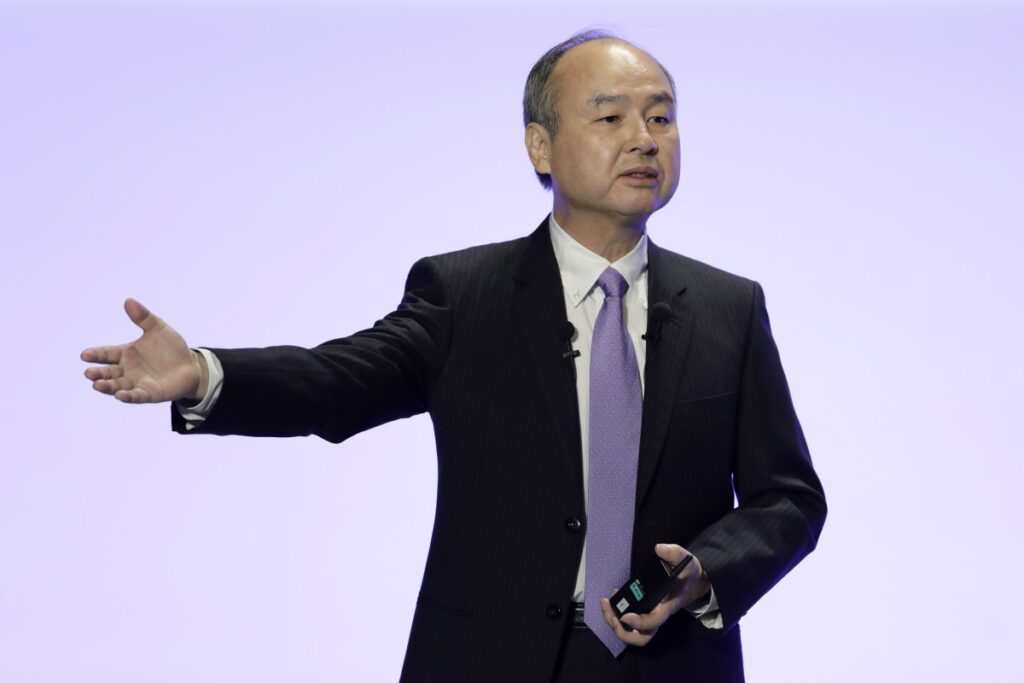

If SoftBank’s investment is finalized, it would mark CEO Masayoshi Son’s most significant bet since the infamous $16 billion plunge into WeWork. Furthermore, this partnership could help alleviate OpenAI’s dependency on Microsoft for computing resources. Microsoft has recently agreed to relinquish its status as OpenAI’s exclusive cloud provider, broadening the operational landscape for both companies.

Looking Ahead: The Stargate Initiative

Stargate is projected to be financed with approximately 20% equity funding, with the balance being sourced through debt against assets and cash flow. OpenAI, having reached a valuation of $157 billion last year, is also eyeing a transition towards becoming a for-profit entity to streamline further fundraising endeavors.

As this partnership develops, its potential implications for the AI landscape are vast. Investing in cutting-edge technology not only fosters growth but also fuels innovation in an industry that is racing towards a transformative future.

In conclusion, SoftBank’s potentially massive investment lays the groundwork for revolutionary advancements in AI, signaling to the world that big players are keen on pushing the boundaries of current technologies. The AI Buzz Hub team is excited to see where these breakthroughs take us. Want to stay in the loop on all things AI? Subscribe to our newsletter or share this article with your fellow enthusiasts.